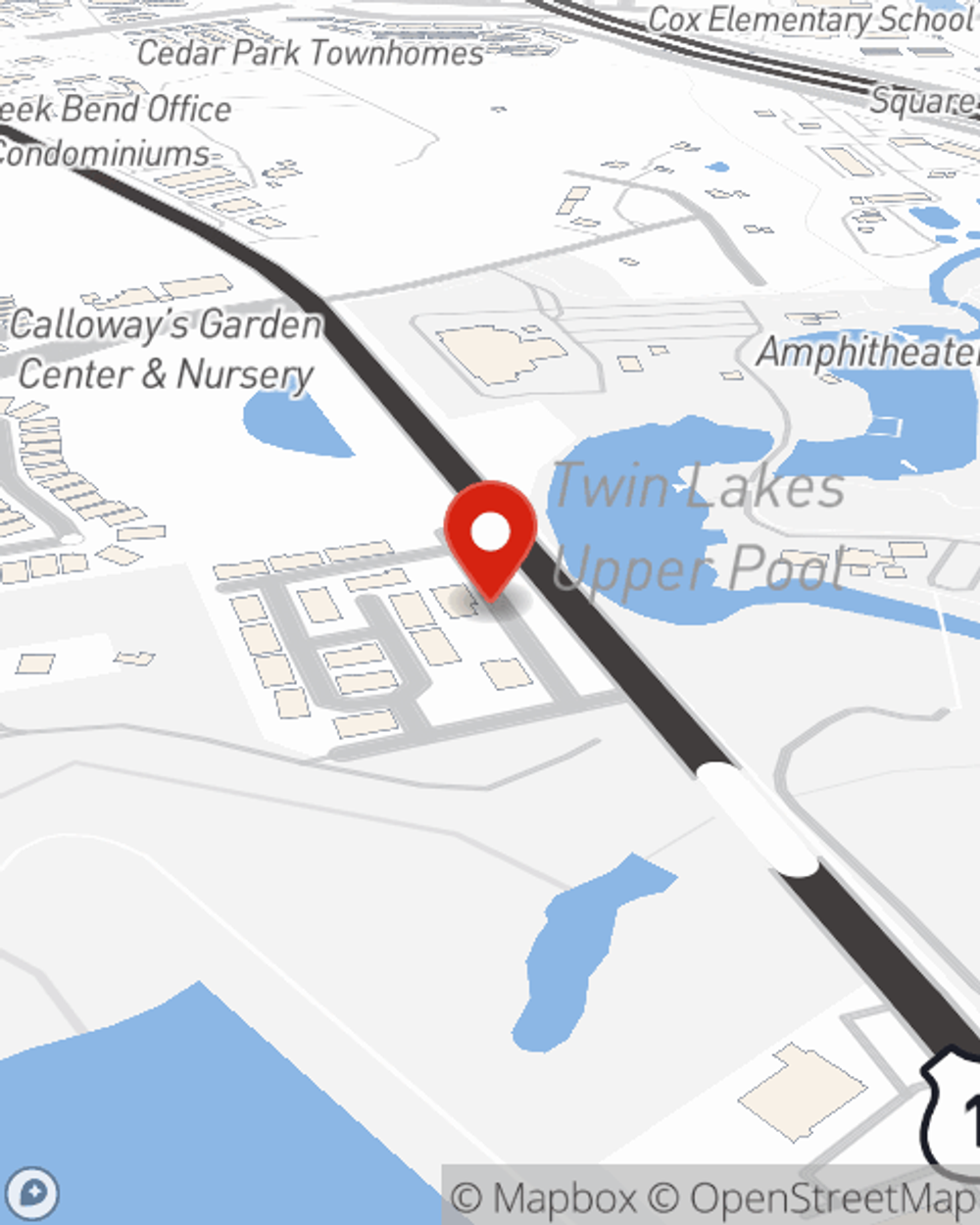

Business Insurance in and around Cedar Park

One of the top small business insurance companies in Cedar Park, and beyond.

Insure your business, intentionally

This Coverage Is Worth It.

Being a business owner is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for those you love. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with a surety or fidelity bond, business continuity plans and extra liability coverage.

One of the top small business insurance companies in Cedar Park, and beyond.

Insure your business, intentionally

Keep Your Business Secure

Whether you own a cosmetic store, a floral shop or a bakery, State Farm is here to help. Aside from great service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Agent Lisa Reed is here to consider your business insurance options with you. Visit with Lisa Reed today!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Lisa Reed

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.