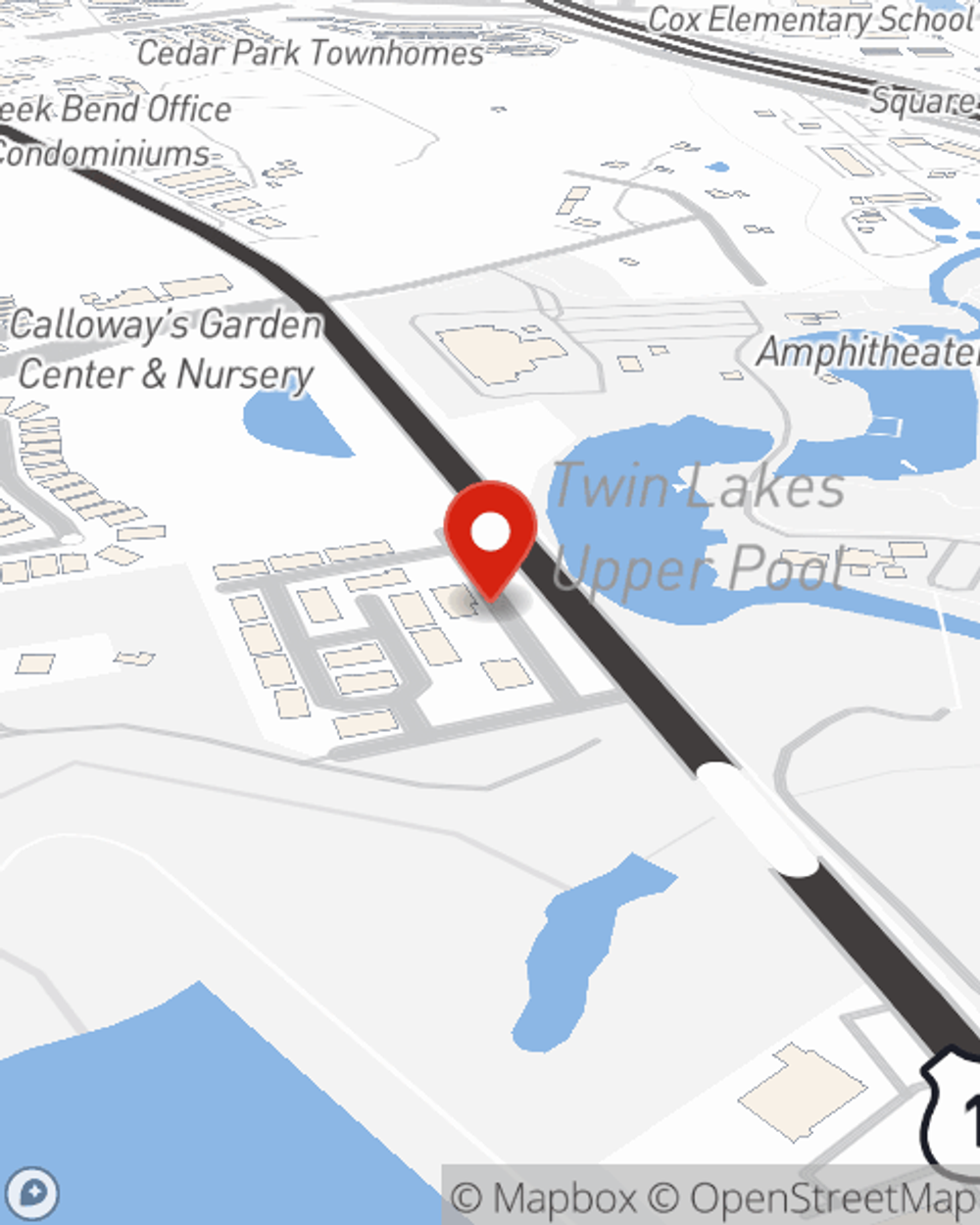

Homeowners Insurance in and around Cedar Park

Looking for homeowners insurance in Cedar Park?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance doesn't just protect your house. It protects both your home and the things inside it. If you experience falling trees or vandalism, you may have damage to some of your belongings beyond damage to the home itself. If you don't have enough coverage, you might not be able to replace your valuables. Some of your belongings can be replaced if they are lost or damaged outside of your home, like if your car is stolen with your computer inside it or your bicycle is stolen from work.

Looking for homeowners insurance in Cedar Park?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Agent Lisa Reed, At Your Service

If you're worried about handling the unexpected or just want to be prepared, State Farm's excellent coverage is right for you. Building a policy that works for you is not the only aspect that agent Lisa Reed can help you with. Lisa Reed is also equipped to assist you in filing a claim if something does happen.

Reach out to State Farm Agent Lisa Reed today to find out how a well known name for homeowners insurance can help protect your home here in Cedar Park, TX.

Have More Questions About Homeowners Insurance?

Call Lisa at (512) 331-0009 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What is an impact-resistant roof?

What is an impact-resistant roof?

Weather such as hail, high winds, snow and ice and even nearby wildfires can weaken or destroy your roof system. Impact-resistant shingles can help.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.

Simple Insights®

What is an impact-resistant roof?

What is an impact-resistant roof?

Weather such as hail, high winds, snow and ice and even nearby wildfires can weaken or destroy your roof system. Impact-resistant shingles can help.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.